-

Transformational Shift: SAP has evolved from SAP ECC’s perpetual licensing model to S/4HANA’s integrated but still flexible model, and finally to RISE with SAP’s cloud-first subscription model with a consolidated, authorisation-based Full Use Equivalent (FUE) system.

-

Dual Migration Paths: Organisations face two distinct migration options when moving from ECC to S/4HANA—Product Conversion (retaining legacy user licences with a flat fee for core functionality) and Contract Conversion (a complete re-licensing into Professional, Functional, and Productivity categories).

-

Engine Licence Consolidation: Core ERP modules are integrated into S/4HANA’s digital core, while specialised add-ons (e.g. CRM, SRM, APO, HCM, and industry-specific modules) may either be re-engineered, remain separate, or become add-on subscriptions under RISE.

-

Enhanced Digital and Infrastructure Considerations: With RISE, digital access via APIs and additional cloud infrastructure add-ons are charged separately, requiring careful management of non-SAP integrations and hybrid deployments.

-

Compliance and Cost Optimisation: Rigorous SAP license compliance audits emphasise the need for internal licence optimisation, thorough role management, and strategic planning during each transition phase to avoid financial penalties, legal risks, and operational disruptions.

At a glance

1. Introduction

SAP’s journey from SAP ECC, its traditional on-premise ERP system, to SAP S/4HANA and, ultimately, to the cloud-first RISE with SAP model is more than just a technological upgrade—it is a fundamental transformation in how enterprise software is licensed, administered, and monetised. This evolution mirrors broader industry shifts from capital expenditure models with perpetual licensing to operational expenditure models built on subscription fees.

This white paper explores the deep evolution of SAP’s licensing landscape, detailing the mapping of user and engine licences across these platforms. It contrasts the legacy SAP ECC environment with the integrated functionalities of SAP S/4HANA and demonstrates how RISE with SAP consolidates these elements into a cloud-based subscription model. Also covered are the implications of compliance audits in this evolving context, along with key considerations and cautionary pointers for customers during both transitions. Finally, the paper discusses the different migration paths available and their respective merits.

2. Understanding the SAP Licensing Transition

The transformation in SAP’s licensing strategy is as significant organisationally and financially as it is technologically. Under SAP ECC, companies operated with a perpetual licensing model that involved separate named user licences and additional module or “engine” licences. These were typically complemented by separate infrastructure costs and maintenance agreements.

SAP S/4HANA marked the beginning of a move away from fragmented licence arrangements. Although still available for on-premise deployment under a perpetual licensing regime, S/4HANA introduces new user licence types and a streamlined approach to bundling functionality. The in-memory HANA database, with its simplified data models and real-time analytics, redefines the value delivered by each module while shifting cost dynamics.

RISE with SAP represents the next step. This cloud-first, subscription-based model bundles not only the S/4HANA Cloud license but also the underlying infrastructure, integrated services, and continuous updates into a single contract. Under this framework, licensing shifts from direct named user counts to an authorisation-based measurement using Full Use Equivalents (FUE), a model that emphasises efficient role management and operational flexibility.

3. User Licence Mapping: From ECC to S/4HANA and RISE

3.1 The ECC User Licence Landscape

Traditionally, the SAP ECC environment has relied on a system of named user licences divided into categories such as:

- Professional Users: Entitling full access to all system functionalities.

- Limited Professional Users: Granting access limited to a subset of transactions and modules.

- Employee Users: Designed primarily for routine self-service transactions.

These licences were acquired on a perpetual basis, accompanied by maintenance agreements that allowed for periodic updates and support without altering the base cost.

3.2 Transitioning to SAP S/4HANA: Migration Options

When planning a migration to S/4HANA, organisations typically face one of two primary approaches to transferring their existing licences:

- Product Conversion:

Under this approach, the existing ECC named user licences are retained for core functionalities. Customers pay a one-time flat fee for the S/4HANA Enterprise Management licence, which covers the essential ERP functions while preserving the original contractual terms. This allows organisations to convert key processes first while leaving more complex industry-specific or LoB solutions to be upgraded at a later stage. Product Conversion thus offers a piecemeal, less disruptive migration route. - Contract Conversion:

Here, all ECC user licences are comprehensively converted into new S/4HANA Enterprise Management licences. This process introduces modern user types aimed at reflecting current usage patterns:- Professional Use (or Advanced User): For users requiring broad access and administrative capabilities.

- Functional Use (or Core User): For roles that need to operate within specific modules or transactions.

- Productivity Use (or Self-Service User): For high-frequency, low-complexity interactions.

In Contract Conversion, for example, an ECC Professional User is re-mapped to a S/4HANA Enterprise Management licence for Professional Use, while ECC Limited Professional and Employee Users are reallocated to Functional and Productivity Use licences, respectively. This holistic re-licensing offers long-term flexibility, albeit with a greater initial review effort.

3.3 The RISE with SAP Paradigm: Full Use Equivalent (FUE) Model

In the next phase of this evolution, the RISE with SAP subscription model consolidates the diverse user types into a unified metric known as the Full Use Equivalent (FUE). Licensing is now measured by authorisations rather than individual usage instances. The conversion roughly adheres to the following:

- 1 Advanced (Professional) User equals 1 FUE.

- 1 Functional (Core) User accounts for approximately 0.2 FUE.

- 1 Productivity (Self-Service) User is valued at roughly 0.033 FUE, meaning that 30 such users together constitute one FUE.

It is essential to emphasise that these ratios are based on predetermined authorisation profiles rather than on the actual number of transactions. Without careful management of authorisations before migration, organisations risk incurring significantly higher licence costs—a risk that some studies estimate may increase expenses by up to 50–150%.

A summarised table of user licensing across the three models is provided below:

This transformation underscores how RISE with SAP simplifies the user licensing model, yet it introduces a need for careful authorisation and role management to avoid unnecessary cost escalations.

4. Engine License Mapping: The Transformation of Functional Modules

4.1 ECC Engine Licensing: A Legacy Model

Within SAP ECC, many engine or module licences were granted for specific functional areas. These were often purchased separately, typically on a perpetual basis, and included crucial ERP functionalities as well as specialised, add-on modules. Examples include:

-

Core ERP Modules:

-

Financial Accounting (FI) and Controlling (CO)

-

Sales and Distribution (SD)

-

Materials Management (MM)

-

Production Planning (PP)

-

Plant Maintenance (PM) and Quality Management (QM)

-

Warehouse Management (WM) and Project System (PS)

-

-

Specialised or Add-On Engines:

-

Customer Relationship Management (CRM)

-

Supplier Relationship Management (SRM)

-

Product Lifecycle Management (PLM)

-

Business Warehouse / Business Intelligence (BW/BI)

-

Advanced Planning and Optimisation (APO)

-

Human Capital Management (HCM)

-

Industry-Specific Solutions (e.g. IS-Oil, IS-Retail, IS-Utilities, IS-Banking)

-

Each engine came with its own separate licence and sometimes usage metrics (orders, revenue, specific business measures) that determined cost. This fragmented approach often led to complexities and inconsistencies in licensing and IT cost management.

4.2 Consolidation in SAP S/4HANA

When migrating to S/4HANA, SAP re-engineered many modules by integrating core functionalities into the S/4HANA Enterprise Management core. This integration has led to a simplified and more standardised approach in licensing. Key points of transformation include:

-

Core Integrations:

-

Finance and Controlling: Now delivered as S/4HANA Finance. The integration simplifies data models and enables real-time analytics by combining the functionalities of FI and CO.

-

Sales, Materials, and Production: S/4HANA modernises the modules for Sales & Distribution, Materials Management, Production Planning, and Warehouse Management using intuitive Fiori user interfaces and enhanced process capabilities.

-

-

Specialised Add-Ons and Conversions:

Certain functionalities, however, still require distinct conversion processes:-

CRM Functionality: Basic CRM processes such as customer data management and sales order processing are now embedded within the core. Advanced CRM capabilities are available through the SAP Customer Experience (C/4HANA) suite.

-

SRM: Traditional SRM functionalities have largely been integrated into S/4HANA’s procurement processes, while advanced supplier collaboration now often leverages SAP Ariba.

-

PLM, BW/BI and APO: In many cases, the ECC versions of these modules have been either re-engineered into the core or now reside in a hybrid model. For instance, business intelligence now leverages the embedded analytics of S/4HANA, although SAP BW/4HANA remains available for more complex reporting.

-

HCM: Since traditional SAP ERP HCM is not part of S/4HANA, SAP recommends migration to SAP SuccessFactors for cloud-based human resources management.

-

Some additional specialised engines (for instance, SAP EHS Management, Product Safety, and SAP Receivables Management) require direct conversion into their corresponding S/4HANA solutions, where a simple flat-fee transition is not applicable.

4.3 Transitioning to RISE with SAP: The Multi-Dimensional Approach

In moving from S/4HANA to RISE with SAP, the mapping of engine licences is further refined with a four-dimensional approach that clarifies how various functionalities are licensed within a cloud environment:

-

Direct User Access to the Digital Core:

– This dimension is governed by the FUE-based licensing model and covers access to the core S/4HANA functionalities inherent in the digital core. -

Digital Access (Indirect Use via APIs):

– Not included in the base RISE subscription, digital access licences cover scenarios where non-SAP applications interact with the S/4HANA core through APIs. SAP typically charges based on the number of relevant documents or transactions processed. -

Industry and Line-of-Business (LoB) Solutions:

– Specialised modules, for example those serving advanced project management, cash flow management or industry-specific needs (such as IS-Oil, IS-Retail, etc.), remain as add-ons requiring separate licensing arrangements. The RISE model allows for these solutions to be added as part of a broader transformation initiative. -

Infrastructure Add-Ons:

– The number of FUEs (user licences) not only determines access rights to the digital core but also influences the amount of cloud infrastructure allocated. Organisations can purchase additional resources—including memory, extra application servers, or additional tenants—if their operational needs exceed the base provision.

An additional nuance introduced in the RISE model is the availability of Compatibility Packs. These packs allow continued use of legacy SAP functionalities within the S/4HANA instance for a defined period (typically until the end of 2025). Compatibility Packs offer temporary relief during the migration but are only applicable for on-premise installations and not for side-by-side solutions.

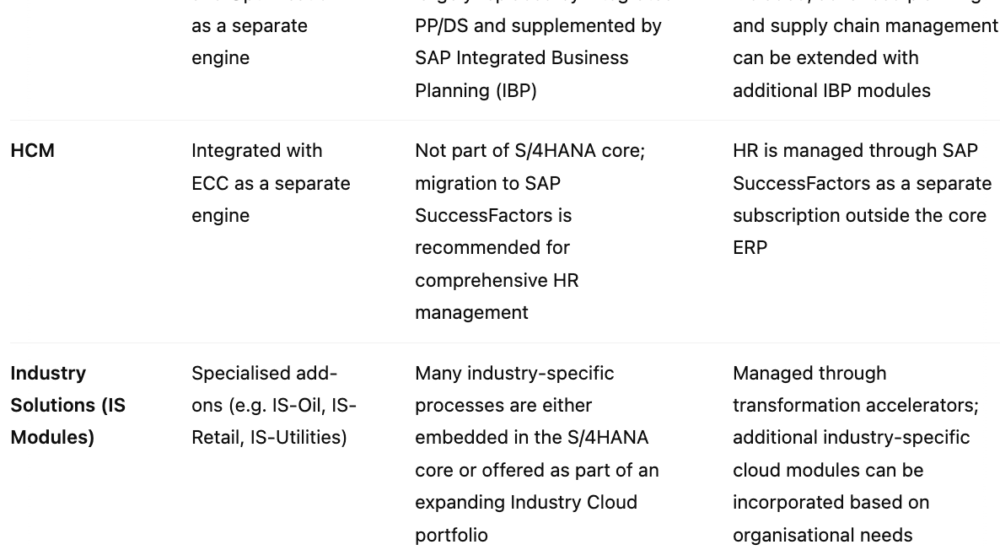

A summarised overview of engine licensing transformations across the three SAP platforms is provided below:

5. Additional Considerations

5.1 Impact of SAP License Compliance Audits

One critical element often overlooked in the transformation process is the impact of SAP license compliance audits. These audits, which have become a routine part of SAP’s engagement with its customers, can have significant legal and financial implications.

Compliance audits aim to ensure that customers use SAP licences within the agreed terms and conditions. As companies transition from ECC to S/4HANA and ultimately to RISE with SAP, the complexity of their licensing arrangements increases. Any misalignment between actual usage and the licences purchased can expose an organisation to:

-

Financial Penalties: Non-compliance may result in additional charges, back-dated fees and, in some cases, fines. Organisations under the new subscription model must be particularly vigilant as audits may flag inefficiencies in role management or instances of “over-authorisation.”

-

Legal Scrutiny: Compliance audits can also be subject to legal review, as discrepancies may be scrutinised in the context of contract law and regulatory requirements. A well-documented and optimised licence strategy is thus not only a cost issue but also a risk mitigation measure.

-

Operational Disruption: The audit process itself, while necessary, can divert resources and attention from core business functions. Companies must prepare by maintaining meticulous records and ensuring that licensing documents are readily available for review.

-

Reputational Impact: Being found non-compliant with SAP’s licensing terms can have reputational repercussions. Demonstrating a proactive approach to licence management and compliance is vital in maintaining good standing with both the vendor and regulatory bodies.

Given these consequences, organisations must incorporate regular licence audits into their broader IT governance practices, especially during transitions when legacy systems and new environments coexist. Robust internal controls, periodic internal audits and clear documentation of authorisation profiles are essential to minimise the risks associated with compliance reviews.

5.2 What Customers Need to Watch Out For During Both Transitions

Both the transition from SAP ECC to S/4HANA and from S/4HANA to RISE with SAP present distinct challenges that require careful strategic planning:

-

During the ECC to S/4HANA Migration:

-

Choice of Migration Path: One of the most critical decisions is choosing between Product Conversion and Contract Conversion. Customers must evaluate whether to preserve existing named user licences (via Product Conversion) or to reconfigure the entire licensing landscape (via Contract Conversion). Each path has cost implications, impacts on authorisation profiles and can influence the pace of the transformation.

-

Authorisation Optimisation: Migrating with suboptimal role definitions can lead to inflated licence costs. Customers should conduct thorough audits of existing user roles and streamline access permissions before migrating to avoid unauthorised or redundant access rights.

-

Integration of Legacy Modules: Certain specialised functionalities may not have a direct equivalent in S/4HANA and require direct conversion. Ensuring a seamless integration while avoiding disruptions in business-critical processes is paramount. Compatibility Packs may bridge some of these gaps temporarily, but they are time-limited.

-

-

During the S/4HANA to RISE with SAP Transition:

-

Adopting the FUE Model: Transitioning to RISE with SAP’s FUE model requires a reevaluation of user authorisations. Customers must ensure that the mapping from traditional licence types to the FUE metrics is optimised to prevent unnecessary cost escalations.

-

Digital Access and API Management: Unlike traditional on-premise licences, digital access through APIs is separately charged under the RISE model. Customers should closely monitor non-SAP integrations and ensure that API-based interactions are strictly governed by internal controls.

-

Hybrid Deployments and Infrastructure: During the transition, organisations may maintain hybrid systems with some workloads remaining on-premise. Managing these dual environments can lead to complexity in licence allocation and infrastructure planning. Additionally, as the number of FUEs influences cloud resource allocation, organisations must plan for any additional infrastructure needs.

-

Contractual Lock-In: A major consideration with RISE with SAP is that once a customer commits to the subscription model, reverting to perpetual licensing is typically not an option. This underlines the importance of a detailed cost-benefit analysis before migration.

-

These points underscore the necessity of a careful, strategic approach throughout the migration process. Ensuring that all stakeholders are involved—from IT governance teams and finance to legal and compliance—is crucial in managing risks and realising the full benefits of the transformation.

6. Conclusion

The evolution from SAP ECC to S/4HANA and eventually to RISE with SAP represents a profound change in both technology and licensing philosophy. The shift involves moving away from complex, perpetual licence models with separate engine modules toward a streamlined, subscription-based model that relies on integrated authorisations measured as Full Use Equivalents. This approach has the potential to simplify licence management and reduce long-term IT complexity; however, it also imposes significant new responsibilities.

Key insights from this white paper include:

-

User Licensing Transformation:

Transitioning from ECC’s named user licences to S/4HANA, whether through Product Conversion or Contract Conversion, sets the stage for the later move into the unified, authorisation-based FUE model within RISE with SAP. Effective role optimisation is paramount to avoid unexpected cost escalations. -

Engine Licence Re-engineering:

Core ERP modules have largely been integrated into S/4HANA’s digital core, while specialised modules require careful conversion and may continue as add-ons. RISE with SAP’s multi-dimensional licensing model introduces new considerations for digital access and infrastructure, making it essential to manage both legacy and modern applications effectively. -

Impact of Compliance Audits:

As licensing models become more nuanced, the risk of audit non-compliance increases. Organisations must prepare for rigorous SAP license compliance audits that can bring financial penalties, legal scrutiny, and operational disruptions if discrepancies are found. Maintaining a robust internal licence management process is therefore critical. -

Critical Considerations During Transitions:

Customers should be mindful of the choices between migration paths (product versus contract conversion), ensure thorough optimisation of user roles, manage hybrid deployments carefully, and prepare for API and digital access costs in the RISE model. A proactive approach will minimise risks and capitalise on the benefits of the new licensing framework.

The transition of SAP licensing, as detailed in this paper, is both an opportunity and a challenge. Organisations can significantly reduce administrative complexity and improve operational agility through careful planning and strategic migration. At the same time, meticulous preparation is necessary to navigate the increased scrutiny of compliance audits and avoid cost inefficiencies during each migration phase.

In conclusion, this transformation is emblematic of the broader shift towards agile, cloud-first enterprise solutions. By understanding the nuanced differences across SAP ECC, S/4HANA, and RISE with SAP, and by closely monitoring compliance and migration challenges, organisations can position themselves to fully benefit from modern ERP innovations while managing risks effectively.